Money-Supply, Debt & A Recession-Depression Of Finance-Capital: Political Economy Of Finance-Capital

The hypothesis of this essay is that the current global recession, and the depression which will follow in the middle of the 2020s, arise from the nature of actually existing capitalism in the US and the West; COVID-19 was merely a catalyst. This capitalism, called hegemonic global finance-capital, is not the textbook capitalism of Smith, Ricardo, John Stuart Mill or the amended versions of Keynes and 20-th Century economists. All that is called classical economics. Marx’s critique in Kapital-I also relates to the classical version. In the writings of all great economic thinkers and particularly Marx you will find signposts pointing to finance-capital but not a full-blown theory.

The hypothesis of this essay is that the current global recession, and the depression which will follow in the middle of the 2020s, arise from the nature of actually existing capitalism in the US and the West; COVID-19 was merely a catalyst. This capitalism, called hegemonic global finance-capital, is not the textbook capitalism of Smith, Ricardo, John Stuart Mill or the amended versions of Keynes and 20-th Century economists. All that is called classical economics. Marx’s critique in Kapital-I also relates to the classical version. In the writings of all great economic thinkers and particularly Marx you will find signposts pointing to finance-capital but not a full-blown theory.

The difference is simple and visible all around. One way to illustrate it is to name institutional actors, another is to say “Look at the variance between what the Chinese economy does and what America does”. The mega actors in the US economy are banks, investment houses, institutions which buy and sell assets (stocks, bonds, mutual funds, financers of commodity trade in oil, food and metals), real estate dealers, currency traders and dealers in funny things called hedges and derivatives. These are the giants; their universal tool the dollar. Ford, General Motors, manufacturers, Standard Oil and Mobil, they are not champs anymore. The big shift in power is from production to finance. Power resides in Wall Street, not Detroit or the Appalachian coal fields.

The other way of making the point is to consider the differences between the economic activities of the US and China. The latter is all about production of goods – commodities as they were once called. Its banks and financial institutions are primitive compared to their American counterparts. China still cannot collate, finance and place a mega-billion-dollar transaction in global markets. The biggest investments were negotiated and signed-off, till recently, in Hong Kong (Shanghai and Shenzhen are getting a small slice now). But China is the supreme workshop of the world.

All this is empirical, not a definition of structure. Classical production-led capitalism is well understood. A few keywords will do: Borrow when necessary > invest in plant > procure materials > employ wage labour > MAKE > sell > appropriate a surplus (profit) > compete > do it all again (reproduction). In a healthy economy the cycle grows ever bigger, profits, plants and the economy expand and population swells. England was the great progenitor; then China in four recent decades drew 400 million people from the countryside into an industrial economy – in the process it all but banished poverty. The nitty-gritty of financing, banking, facilitating distribution, transport, insurance and marketing needs an activity structure. Classical capitalism is the totality of the interacting parts of this activity structure; it keeps the production and distribution processes alive.

Of course, from the beginning those who dealt in money only, had a place. Borrow money when necessary I said! But from whom? Investors would be syndicated by banks which managed and underwrote deals. Deposit the profit, accumulate and reinvest, I implied. Financial conglomerates and banks to the fore. Insure, issue letters of credit and so on. Well the East India Company started life as a body of investors did you know?

Finance-capital came into its own when the money part of the economy become dominant; when handlers of money grew more powerful than manufacturers, when bankers conquered industrialists. The theory goes back to Rudolf Hilferding’s Finance Capital published in Vienna in 1910 – he had been propagating it from earlier. The key concepts: a) A huge aggregation of capital had taken place over the decades and capitalism’s structure was no longer the same, b) capital had become monopolist and was no longer competitive, and (c) movements of capital to colonies was opening new vistas (tea plantations say). This last aspect attracted the word imperialism. I am not sure how valid Hilferding’s second point about monopoly is today (Apple vs. Samsung vs. Huawei vs. Sony?). And today the word imperialism is more about military than investment hegemony. His focus on amassed capital and its functioning as the force dominating the economy, however, remain central and cardinal.

The structure and complexity of modern finance-capital is deeper than any analyst before WW2 had foreseen. The nature of recent crisis, particularly the 2008-9 Great Recession and 2020 recession are unlike previous crises which were linked to overproduction, supply-demand imbalance and the ups and downs of the business-cycle. Nor are they similar to the supply-side shock and stagflation conundrum that followed oil price hikes. Instead, recent crises are located in the domain of finance and arise from instabilities in that system itself. In 2009 it started with mortgages, subprime loans and the unravelling of financial derivatives which in turn threatened the very existence of some of the biggest banks in the US and Europe. The world of finance, the structure of financial systems, started coming apart. This was the first ever major collapse of a financial system per se.

If a financial crisis does not originate in supply-demand imbalance, overproduction, loss of markets due to defeat in war, or supply-chain disruption, then what dynamic causes it? It arises from malfunctions of the financial sector itself. Say banks are overstretched by pursuit of excessive lending since as financial institutions they make money only by expanding their balance sheets (recall subprime mortgages); say hedge and investment funds are overstretched as creatures that live in a world of financial speculation and risk taking; say government runs deficit upon deficit and borrows into trillion-dollar indebtedness; say student and credit card debtors are defaulting; say inequity of wealth and income are so large that living standards of most people is falling. Then what?

Hyman Minsky’s answer was this. There will be a god-almighty psychological collapse (the Minsky Moment) because the very inmates of the financial universe will panic and lose confidence due to accumulation of risk. They will dump what they can making things worse. The central bank will panic and burn the midnight oil running its printing presses (they call it Quantitative Easing QE). It doesn’t get better after a few ups and downs; eventually recession turns into depression. The Great Depression of the 1930s devasted manufacturing, agriculture and mining but it too, psychologically, was sparked off by events in the financial sector – a wrong turn on interest rates in that case.

Nissan Motor Co may close down in USA; the biggest car rental Hertz has filed for bankruptcy – it also owns Thrifty and Dollar. The biggest Trucking company Comcar which has 4000 trucks has filed for bankruptcy so has America’s oldest retailer JC Penny. The Biggest investor in the world Warren Buffet lost $50 billion in the last 2 months and the biggest investment company in the world Blackrock which manages $7 trillion is signalling disaster. The biggest mall, Mall of America, has stopped making mortgage payments. Emirates is laying off 30% of its workforce.

It is estimated by website www.zerohedge.com which I cannot vouch for that 12,000 to 15,000 businesses will close. These well-known retailers have announced closure: J. Crew, Gap, Victoria’s Secret, Bath & Body Works, Forever-21, Walgreens, Sears (can’t be!), Nordstrom, Macy’s (what!), Bose, Kmart and more. I find all this hard to believe but that’s what the web says. And to rub salt into these wounds, massive mortgage loan defaults, credit card defaults and auto loan defaults are expected. Unemployment claims reached an all-time high of 40 million out of a 160 million working population. When people are broke consumer demand falls and the economy goes into a conventional production-cycle type recession, then a depression. GDP will decline by 5.2% world-wide in 2020; US GDP will fall by over 6%. I don’t see much sign of an upturn in early 2021. There will be a see-saw in 2021-Q3/Q4, maybe into 2022/23, but the die is cast. There is no logic or reason why a money printing, money speculating system of finance-capital can recover health or hegemony.

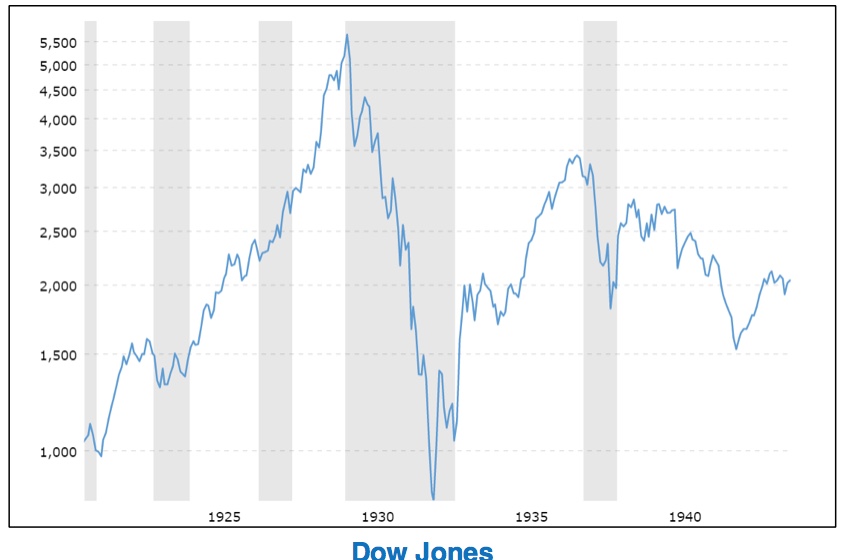

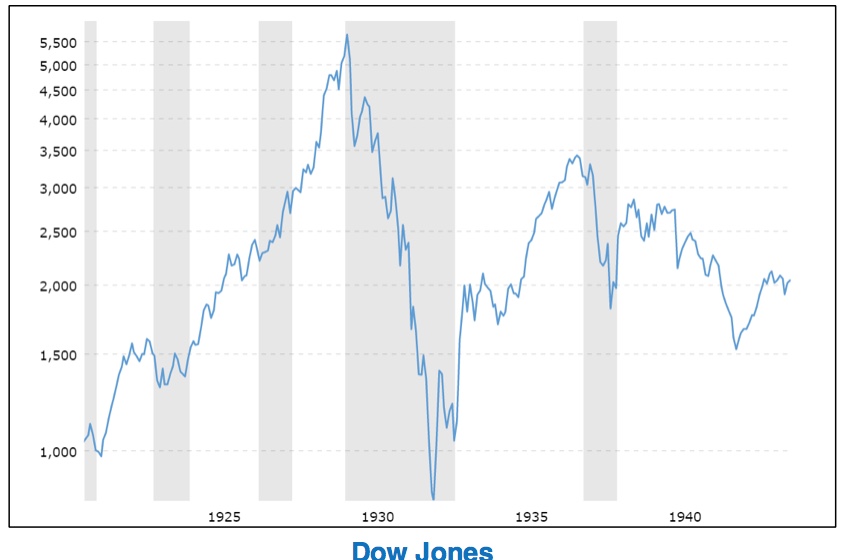

The economic universes of the 1930s and the 2020s are vastly different from each other; their trajectories will diverge but I am reproducing graphs of 1930s economy in America to make a few points. The huge rise in unemployment and the collapse of the stock market (DOW) first in 1930-32 and then in 1937 is what is called the two W-shaped recessions which straddled the Great Depression. Unemployment in the US right now is not much below 20% and this is not far from the worst in late 1933. However, while in the 1930s stock prices were depressed right now all stock indices are going through the roof reaching record highs – asset price inflation. How different! This is a specific feature of how the Fed is responding differently to crises in the era of finance-capital; it is ‘going monetary’ like crazy. Collapse in the era of finance-capital invokes mad money printing and zero interest rates since central banks have no other tools to respond with.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.