Visualized: The Power of a Sustainable Investment Dollar

Visualizing the Power of a Sustainable Investment Dollar

By Dorothy Neufeld-

Sustainable investments are booming.

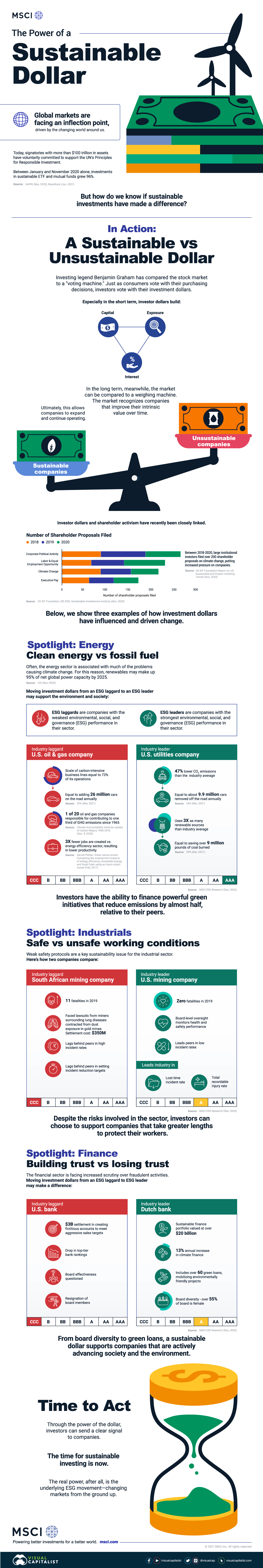

Between January and November 2020 alone, investments in sustainable ETF and mutual funds grew 96%. The UN Principles of Responsible Investment now has over 3,000 signatories representing over $100 trillion in assets. The U.S. Commodity Futures Trading Commission established a Climate Risk Unit to analyze climate risk across derivative markets, and as of March 2021, new sustainability disclosures have come into effect in Europe.

But how do we know if sustainable investments have made a difference?

To answer this question, the above infographic from MSCI examines the effect of a sustainable investment dollar by looking at real-world examples.

A Sustainable vs. Unsustainable Dollar

To start, investing legend Benjamin Graham has compared the stock market to a “voting machine.” Just as consumers vote with their purchasing decisions, investors vote with their investment dollars. Especially in the short term, as more dollars flow to sustainable companies, this builds their exposure and access to capital.

In the long term, meanwhile, the market can be compared to a weighing machine. The market recognizes companies with profitable business models that improve their intrinsic value over time. Ultimately, this allows sustainable companies to expand and continue operating.

Given the rising momentum in both green assets and climate targets, here is how investment dollars have influenced and driven change across three industries.

1. Clean Energy vs. Fossil Fuel

Over the last several years, the energy sector has been associated with many of the problems causing climate change. For this reason, many investors are seeking out greener energy alternatives. But how does moving investment dollars from an ESG laggard to an ESG leader support the environment and society?

First, here is a brief explainer of ESG laggards and leaders:

- ESG laggards: companies with the weakest environmental, social, and governance (ESG) performance in their sector.

- ESG leaders: companies with the strongest environmental, social, and governance (ESG) performance in their sector.

| Industry laggard: U.S. oil & gas company | Industry leader: U.S. utilities company |

|---|---|

| Scale of carbon-intensive business lines equal to 73% of its operation | 47% lower CO2 emissions than the industry average |

| This is the equivalent of adding 26 million cars on the road annually | This is the equivalent of removing 9.9 million cars off the road annually |

| 1 of 20 oil and gas companies are responsible for contributing to one third of GHG emissions since 1965 | Uses 3X as many renewable sources than industry average |

| 3X fewer jobs are created vs. energy efficient sector, resulting in lower productivity | This is roughly the same as saving over 9 million pounds of coal burned |

| MSCI ESG Rating: CCC | MSCI ESG Rating: AAA |

Source: MSCI ESG Research

Based on the above example, investors have the ability to finance powerful green initiatives that reduce emissions by almost half, relative to their peers.

2. Safe vs. Unsafe Working Conditions

Weak safety protocols are a key sustainability issue for the industrial sector. Here’s how two companies compare:

| Industry laggard: South African mining company | Industry leader: U.S. mining company |

|---|---|

| 11 fatalities in 2019 | Zero fatalities in 2019 |

| Faced lawsuits from miners surrounding lung diseases contracted from dust exposure in gold mines Settlement cost: $350 million |

Board-level oversight monitors health and safety performance |

| Lags behind peers in high incident rates | Leads peers in low incident rates |

| Lags behind peers in setting incident reduction targets | Leads industry in lost time incident rate & total recordable injury rate |

| MSCI ESG Rating: CCC | MSCI ESG Rating: A |

Source: MSCI ESG Research

Despite the risks involved in the sector, investors can choose to support companies that take greater precautions to protect their workers.

3. Building Trust vs. Losing Trust

Over the last several years, the financial sector has faced increased scrutiny over fraudulent activities. Moving investment dollars from an ESG laggard to ESG leader may make a difference:

| Industry laggard: U.S. bank | Industry leader: Dutch bank |

|---|---|

| $3 billion settlement in creating fictitious accounts to meet aggressive sales targets | Sustainable finance portfolio valued at over $20 billion |

| Drop in top-tier bank ratings | 13% annual increase in climate finance |

| Board effectiveness questioned | Includes over 60 green loans, mobilizing environmentally friendly projects |

| Resignation of board members | Over 55% of board is female |

| MSCI ESG Rating: CCC | MSCI ESG Rating: A |

Source: MSCI ESG Research

From board diversity to green loans, a sustainable investment dollar supports companies that are actively advancing society and the environment.

Sustainable Investment: The Time to Act

Recently, investor dollars and shareholder activism have been closely linked.

Between 2018 and 2020, large institutional investors filed 217 shareholder proposals on climate change alone, putting increased pressure on companies. Meanwhile, 270 proposals were filed on corporate political activity and 228 on fair labor and equal employment opportunity over the same timeframe. Across all ESG proposals, $2 trillion in assets were pushing for more equitable corporate action.

Through the power of a dollar, investors can send a clear signal to companies: the time for sustainable investing is now.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.