Saving national assets: Reform and privatise key SOEs to serve general public

Thursday, 28 April 2022

IMF assistance

On 12 April 2022 the Government of Sri Lanka (GoSL) announced it is seeking unilateral deferment for all the foreign debt except trade creditors issued by the GoSL. This is the latest in a series of events taking place with the appointment of the new Central Bank Governor and the Secretary of the Treasury. Sri Lanka is seeking IMF assistance, possibly an Extended Fund Facility (EFF). The IMF assistance through an Extended Fund Facility (EFF) is extended when a country faces serious medium-term balance of payments problems because of structural weaknesses that require time to address.

all the foreign debt except trade creditors issued by the GoSL. This is the latest in a series of events taking place with the appointment of the new Central Bank Governor and the Secretary of the Treasury. Sri Lanka is seeking IMF assistance, possibly an Extended Fund Facility (EFF). The IMF assistance through an Extended Fund Facility (EFF) is extended when a country faces serious medium-term balance of payments problems because of structural weaknesses that require time to address.

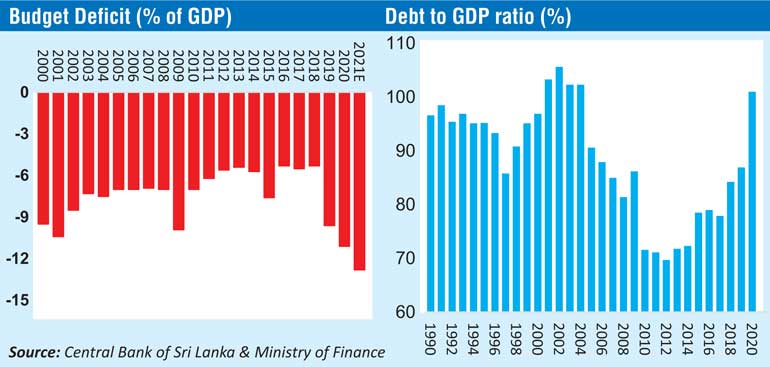

The country’s debt stock has grown over the years due to profligatory expenditure in building uneconomical infrastructure projects with questionable socioeconomic benefits. The public debt is unsustainable and Sri Lanka has to immediately start a debt restructuring exercise. The IMF program will require the GoSL’s commitment to undertake a series of economic reforms.

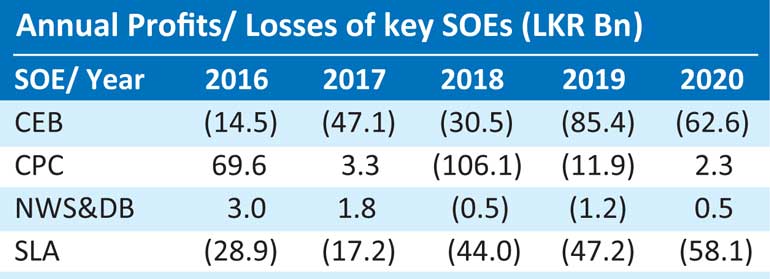

The Article IV Consultation report of the IMF on Sri Lanka released early this year has outlined the basic set of reforms required by the IMF in order to carefully navigate the economic crisis. IMF states that “cost-recovery based energy pricing is needed to mitigate fiscal risks from state-owned enterprises (SOEs). With retail fuel and electricity prices generally set below cost-recovery levels on a discretionary basis, the CPC and the Ceylon Electricity Board (CEB) have been loss-making for years, and the resulting debt overhang has hindered new investments.” Further, the report present that “the stock of state-owned enterprise (SOE) debt reached 15.8 percent of GDP in 2020”.

Given the severity of the crisis, moving into a market-based energy pricing mechanism alone is insufficient. There are a large number of SOEs providing key essential services to the citizens of Sri Lanka. Ceylon Petroleum Corporation (CPC) is the major petroleum products retailer. Litro Gas commands major market share in the domestic LP gas market, providing LP gas for both domestic and industrial use. Ceylon Electricity Board (CEB) is the sole supplier of electricity within the country. However, there are certain independent power producers (IPPs) generating and selling electricity to CEB through power purchase agreement (PPAs). CEB manages the National Electricity Grid; the transmission network and the distribution network through which consumers are being connected. Apart from CEB, Lanka Electricity Company (LECO) manages small-scale distribution network in certain urban areas.

However, there are certain independent power producers (IPPs) generating and selling electricity to CEB through power purchase agreement (PPAs). CEB manages the National Electricity Grid; the transmission network and the distribution network through which consumers are being connected. Apart from CEB, Lanka Electricity Company (LECO) manages small-scale distribution network in certain urban areas.

The cost of electricity generation has increased along with the increase in international oil prices and with the depreciation of Sri Lankan rupee (LKR) against the US dollar. Despite the heavy reliance on fossil fuel, especially furnace oil and diesel for electricity generation in Sri Lanka to provide major portion of the peak energy demand, the Government has been reluctant to increase the consumer price of electricity.

The SOEs are highly inefficient and in debt due to persistent wrong policies adopted by successive governments. It is of paramount importance that the Government adopts a market-based pricing policy for the services provided by main SOEs to ensure that consumers pay the right price. The IMF has highlighted the need for market-based pricing mechanism for energy pricing. Adoption of market-based pricing formulas are required for key Government services such as provision of electricity, fuel, LP gas and transports services such as trains and buses.

In addition, most of these SOEs are highly overstaffed. The average salary of most SOEs are many times higher than average Government sector salary. These monopolistic utilities finally pass down the cost of inefficient management and higher wages to consumers and taxpayers.

Power sector and CEB

Major reforms in the power and energy sector encouraging more private sector participation and Foreign Direct Investments (FDIs) in the generation of electricity are required. Both CEB and CPC are highly in debt and the CEB has no capacity to develop large-scale power plants required to provide continuous uninterrupted power supply to the country. Further, while capital investments by SOEs have proven to be inefficient it is also viewed as one of the major sources of corruption.

Serious structural reforms in the CEB are required to face the future challenges in the energy demand of Sri Lanka. The country has not been able to develop sufficient power plants to fulfil the energy demand. Despite almost 100% electrification, Sri Lanka is short of electricity to fulfil its peak demand and the generation cost has been one of the highest in in the region. This is because of high dependence of fossil fuel. Although there is significant availability of renewable resources especially wind and solar, Sri Lanka has not been able harnesses them. Since there are limited feasible hydro resources, further development in large scale hydro resources are not expected. Sri Lanka should harness the full potential of development in wind and solar resources to meet the country’s growing energy requirement.

CEB has been reluctant to permit the addition of more renewable energy plans to the national grid citing concerns of grid stability. There are no public discussions about how modern grids are managed to accommodate a large share of renewable energy which is believed to be non-firm sources of energy as the supply depends on nature; this energy has to be fed in as and when it is available. CEB currently runs the baseload with coal and fossil fuel based thermal power plants. To meet the peak demand, certain large reservoir based hydro power plants are added. These hydro plants use the water released for agriculture purpose at night. As with the climate changes, Sri Lanka is facing a serious difficulty in meeting the demand, especially the peak demand through this mechanism with limited water resources and small number of hydropower plants.

certain large reservoir based hydro power plants are added. These hydro plants use the water released for agriculture purpose at night. As with the climate changes, Sri Lanka is facing a serious difficulty in meeting the demand, especially the peak demand through this mechanism with limited water resources and small number of hydropower plants.

In the future, CEB role should confined to the management of national grid and distribution of electricity nationally. It is also required to obtain technical assistance in grid management to ensure more renewable energy plants are added to the national grid, significantly enhancing the contribution of the renewable energy sector in the national energy composition.

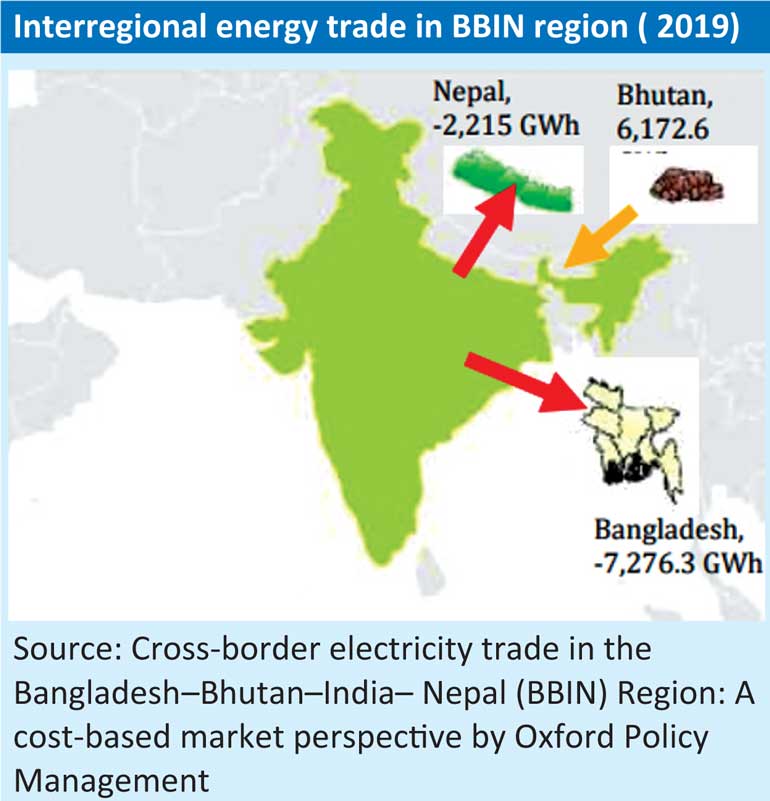

For instance, the country should explore the possibility of integrating our national grid with that of India in order to ensure continuous energy supply, thereby improving our economic competitiveness and economic integration with India. Sri Lanka can learn from Nepal, Bhutan and Bangladesh in this regard. Despite vast potential of hydropower, Nepal had faced serious difficulty in meeting its energy demand. Long power cuts were prevalent in the past. Consequently, Nepal undertook the development of large-scale hydropower plants while integrating its national grid with India. This allows Nepal to export excess energy generated in the rainy season when the hydro plants are running at full capacity. In the dry season Nepal imports energy from India. This grid integration has provided Nepal with uninterrupted power supply at a relatively cost-efficient manner. Similarly, Bhutan is also connected with the Indian grid. Bhutan, being a country with rich natural hydro resources, has potential to produce large excess hydro energy. This grid integration has provided Bhutan with the opportunity to export excess energy to India. Cross-border electricity trade in the Bangladesh-Bhutan-India-Nepal (BBIN) Region facilitated these countries to provide uninterrupted energy for their industries while managing their national grid effectively with large renewable energy plants.

The integration of our national grid with Indian electricity grid should enable us to harness the full potential of vast wind and solar resources available in the north and Hambantota district while managing the national grid.

Exploration of hydrocarbon resources

The country has been struggling to explore petroleum resources in the Mannar Basin despite several studies confirming the availability of commercially viable hydrocarbon resources. The country should devise a mechanism to attract international energy players to commercially explore hydrocarbon resources available in the Mannar Basin. With high oil prices remaining around $ 100 per barrel, Sri Lanka should immediately seek international assistance for exploring hydrocarbon resources in the Mannar Basin.

CPC and downstream petroleum market

CPC and downstream petroleum market

There is a duopoly in the downstream petroleum market in Sri Lanka where CPC claims a larger market share. More competition in the downstream petroleum market is required. In order to incentivise downstream petroleum retailers, the country should adopt a market based energy pricing mechanism, through a transparent energy pricing formula. Frequency of energy pricing should be on a monthly basis at minimum. Facilitating petroleum retailers to earn USD income, energy sales to industrial and export oriented companies in US dollars should also be permitted.

Banking assets

The Government should privatise the ownership of SOEs through an appropriate market-based privatisation process similar to policy in privatising the telecom sector. Public sector banks require capital infusion. In order to enhance the eroding capital base of public sector banks, three main public banks, namely Bank of Ceylon, People’s Bank and National Savings Bank should be privatised while amalgamating small banks with those larger banks. This consolidation is healthier and will improve the soundness of the domestic banking system. The private sector management and private capital will enable the Sri Lankan banking system to improve the capital base and its competitiveness.

In addition to the utilities and the banking assets, the Government of Sri Lanka owns a large number of business ventures including Sri Lanka Insurance and subsidiary companies; Litro Gas, Lanka Hospitals and some hotel properties.

LPG and Litro Gas

Along with moving to market-based energy pricing, improving the storage capacity of LP gas is also required. State-owned Litro Gas has not been able to generate sufficient capital for the investment in storage capacity, as a result, country’s LPG gas storage capacity is insufficient. Ownership of Litro Gas should be privatised inviting experienced international FDIs through liberalisation of domestic LP gas market. In order to get an immediate budgetary support, the government should look for a suitable and transparent privatisation program for Sri Lanka Insurance, Lanka Hospitals and other hotel properties include including Hilton and Grand Hyatt.

PPP and port terminals

Sri Lanka witnessed an early success in introducing public private partnership (PPP) through built, operate and transfer (BOT) model to develop major port terminals in the Port of Colombo. The Colombo Port’s excellent performance status is backed by the performance of SAGT and CICT. The balance two terminals in the South Port; East Container Terminal (ECT) and West Container Terminal (WCT) are yet to be developed. Initially, ECT was to be developed with an investment from Japan and India jointly, however due to resistance from the Sri Lanka Port Authority (SLPA) trade union, the Government decided to offer West Container Terminal to Adani Group in India. Adani Group is a major port terminal developer from India.

SLPA went ahead with the development of East Container Terminal; however, the progress has been slow, possibly due to lack of funds. If the SLPA is unable to develop ECT on time the Port of Colombo will be losing its competitiveness in the region. Therefore, if SLPA is not in a position to develop ECT on time, the Government should take a policy decision to immediately approach Japan for foreign investment for the balance part of the terminal along with the assignment of management rights of ECT. This will facilitate and enable Port of Colombo to continue with adding sufficient capacity to meet the growing demand in the region.

Concept of national assets

Concept of national assets

The concept of national assets is grossly misunderstood in Sri Lanka. This misconception is created by the politicisations with left centric ideology. If the asset cannot provide the efficient service to its customers and draw funds from the taxpayers, then it rather become a liability. Most of our SOEs have become liabilities where political appointments are common. Most SOE appointments are made by the ministers of the respective governments. The workforce is highly politicised and unionised. Due to the inefficient management appointed by politicians and politically motivated workforce most SOEs are major drains on public funds.

Wherever private sector management is involved, the productivity is higher and there is greater savings as a whole. Good examples are port terminals and the telecom sector where privatisation helped to retain competitiveness while offering best services and competitive prices to the general public. The concept of national assets should be viewed in relation to its productive management in offering competitive customer service being internationally competitive, not in relation to the ownership. The general public should be educated about the benefits of private sector management in these assets.

(The writer is a CFA charterholder, capital market specialist and certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)

%20(1)%20(3)%20(1)%20(1).png)

No comments:

Post a Comment

Note: only a member of this blog may post a comment.